The inflation happening right in front of us: government-backed student loans

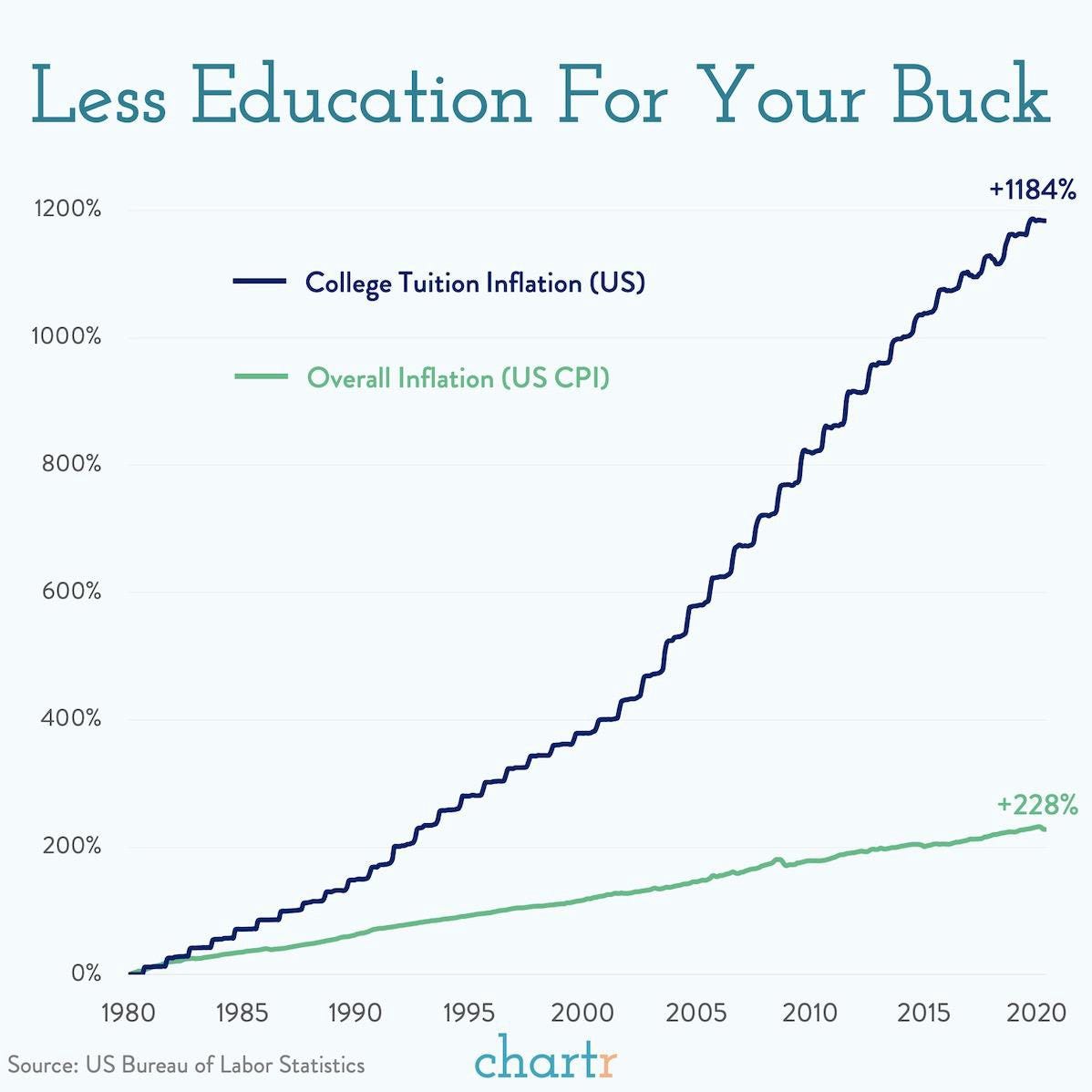

The acceleration in tuition costs in the past 30 years has a surprisingly simple origin, mostly stemming from Title IV of the Omnibus Budget Reconciliation Act of 1993:

Title IV: Student Loan ERISA Provisions — Subtitle A: Direct Student Loan Provisions — Student Loan Reform Act of 1993 — Amends the Higher Education Act of 1965 (HEA) to replace the Federal Family Education Loan Program, under which loans made by private lenders are guaranteed by the Government with a Federal Direct Student Loan Program, to be partially phased in over a five-year transition period.

Up until 1993, the federal government merely guaranteed/backed student loans that private lenders gave. This meant that only in the case of someone defaulting on their loan would the government be on the hook, stepping in and paying the college what’s owed.

This amendment completely overhauled that system, making it so that for the vast majority of student loans, the federal government directly made the loans to students. More specifically, the federal government pays the universities/colleges up front, and the student then owes the government that money.

This represented a large shift in the alignment of incentives. When the loans come from the federal gov, there’s much less pressure on schools to compete on price. This is especially true since “increasing max student loan size => making college more accessible to everyone” is a political argument that both major parties benefit from in terms of optics.

Unsurprisingly, this decision lead to exactly what the Bennett Hypothesis predicted in 1987, that “colleges will raise tuition when financial aid is increased” in order to capture as much of that government money as possible.

In essence, the feds handed colleges a blank check, and the result is just as expected for a decision like that.

The question then becomes a matter of how we fix this without diminishing access to a college education. In my personal view, the feds should handle student loans the same way they handle medicaid/medicare reimbursement.

To elaborate on that analogy,hospitals/medical practices can only be reimbursed by medicaid/medicare up to a certain predetermined amount that the government calculates based on what those procedures generally cost to administer.

Given that the vast majority of universities are non-profit, the government can determine what it reasonably costs to operate a school and have enough extra for needed expansion, while factoring in some sort of adjustment/multiplier for differing costs of operation/salaries depending on location.

In other words, the feds have the leverage here, and should say “this is what we estimate it costs per student per year to run your school, so this is the maximum in student loans that we will provide”. The schools would still be free to charge more than that amount if they want, but it will be up to them to figure out how they plan to get that extra amount.

Close to 70% of college students attend using federal student loans, so schools would have no choice but to adjust their tuitions to match that maximum, or risk losing a large chunk of revenue.

As with many things, it seems the optimal strategy to solve this would involve several initiatives, rather than just one holy grail. Coupled with this regulation on max tuition, making all state universities tuition-free (totally tax-funded) would do a great deal in adding more price competition, especially considering about 80% of American college students attend public institutions.

Here’s hoping that our elected officials finally focus on this underlying cause!